Fab Form Industries

Building on a solid foundation

In this post, I will briefly introduce you to a small Canadian company that you have probably never heard of, Fab Form Industries.

Fab-Form is a firm that manufactures, develops, and distributes technology to “form concrete footings, columns, foundations, and walls for building structures.” An example of their products is Fastfoot, a 100 feet (30 meters) long roll made of high-density polyethylene fabric used as a substitute for lumber when making foundations for houses. One roll of Fastfoot forms the same amount of concrete as 1500 pounds (680kg) of timber, which works as a solid sales argument when lumber prices are high. All of their products provide similar intelligent solutions, and the general theme is that they make the job easier and cheaper for builders. For a complete product lineup, check out this link.

About half of the products are patented, and a fabric development agreement was signed with Hagihara Industries late last year. The company actively seeks to expand its product offering and develop new products, which will help drive growth going forward.

Financial History

What’s fascinating about this firm is the minuscule size, coupled with a solid track record. Over the past ten years, they have grown their operations with a CAGR of roughly 28%. Despite the stellar growth, the annual revenue is only CAD 4 million, or approximately SEK 28 million. Margins have been improving quite nicely over the past six years, and the LTM EBIT margin is 21%. I attach a 20-year overview of Revenue and EBIT below:

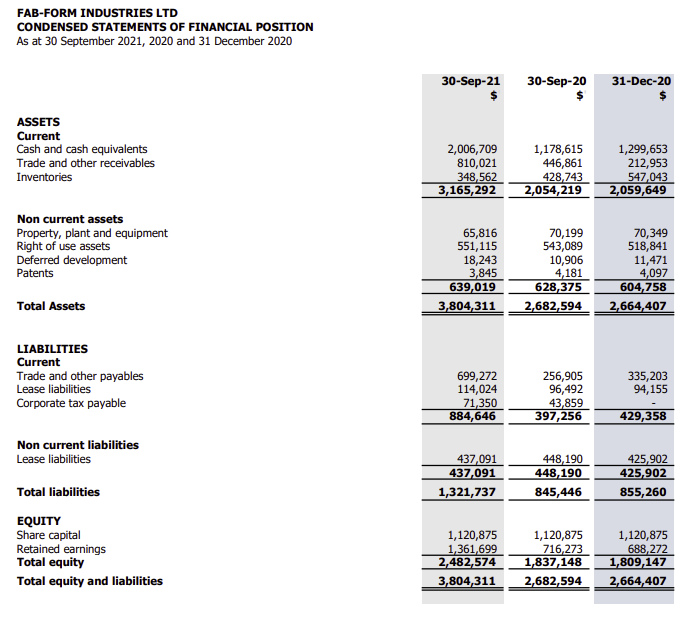

In addition to growing quickly, the company remains very cautious about its financial position. Management has actively chosen not to take on any debt, with the balance sheet from the Q3’21-report below:

The lease liabilities arise due to renting its offices, and the only other noteworthy post on the balance sheet is the massive cash position. Pretty much all of what the company earns is simply ending up on the balance sheet as cash. Although this may be considered poor capital allocation, I see it as a nice cushion given the high reliance on specific products and small size. The firm is currently dependent on only nine different products. Although this is one of the main drawbacks of the investment thesis, it is to be expected given its modest size. I have seen no announcement from the firm regarding what they will do with the cash, but buybacks or acquisitions are probably the most likely option.

Valuation

The company is cheap, trading at an EV/EBIT multiple of around 7,4 (on LTM earnings). Although this figure could be boosted by the solid third quarter of 2021, I see no real reason for the sales growth to slow down as we advance. An argument could be put forth regarding the profitability during the last year. The margins were higher than historically and arguably higher than what is reasonable to expect. However, there are no clear indicators of why the margins would drastically be reduced, and the trend points toward increasing profitability rather than the opposite.

The P/B is around 3.5, but it’s is not very telling as the business is asset-light, and most of the assets are cash anyway.

It can also be worth mentioning that insider ownership remains pretty strong. The management and owner (with family) own more than half of the outstanding shares.

Investment Thesis

Despite extrapolating the current growth in earnings, I am probably not qualified for predicting where the firm is heading. If the company continues as they have done historically, the increase in share price will naturally follow. However, even if the firm stops growing entirely and maintains the current sales/earnings, the valuation still seems tolerable. As such, this is an opportunity where on the one hand, you can win a lot, and on the other, you probably won’t lose much.

Main Risks

To conclude, I list the principal risks of the business. They are by no means insignificant and should be considered seriously:

Management is quite old, and they will have to find suitable candidates to replace them.

Not all of its products are patented, constituting a significant risk if competitors manage to imitate their ideas and put pressure on margins.

It is tiny, and the company discloses limited quantities of information regarding the business (which could also be seen as an advantage for small investors.)

The liquidity in the stock is low, which will cause the stock price to be volatile at times.

The firm’s cyclicality and dependency on a strong housing market are not well documented, as most of its growth has taken place after the real estate crash of 08. It is worth noting that the company is not exposed to the real estate prices per se, but rather the number of new houses built.

Thank you for reading!

Feel free to contact me via Twitter @vardevalpen if you have any questions or issues that you would like to discuss. See you next time!

Hello Martin. One of our board members Nigel Protter met you on his trip to Europe recently. I wanted to thank you for your article which articulated well the risks and benefits of our company. Our 2nd quarter financials will be released soon and you will see that your predictions are correct. Please contact me any time at rick@fab-form.com.

Sincerely, Rick Fearn, CTO